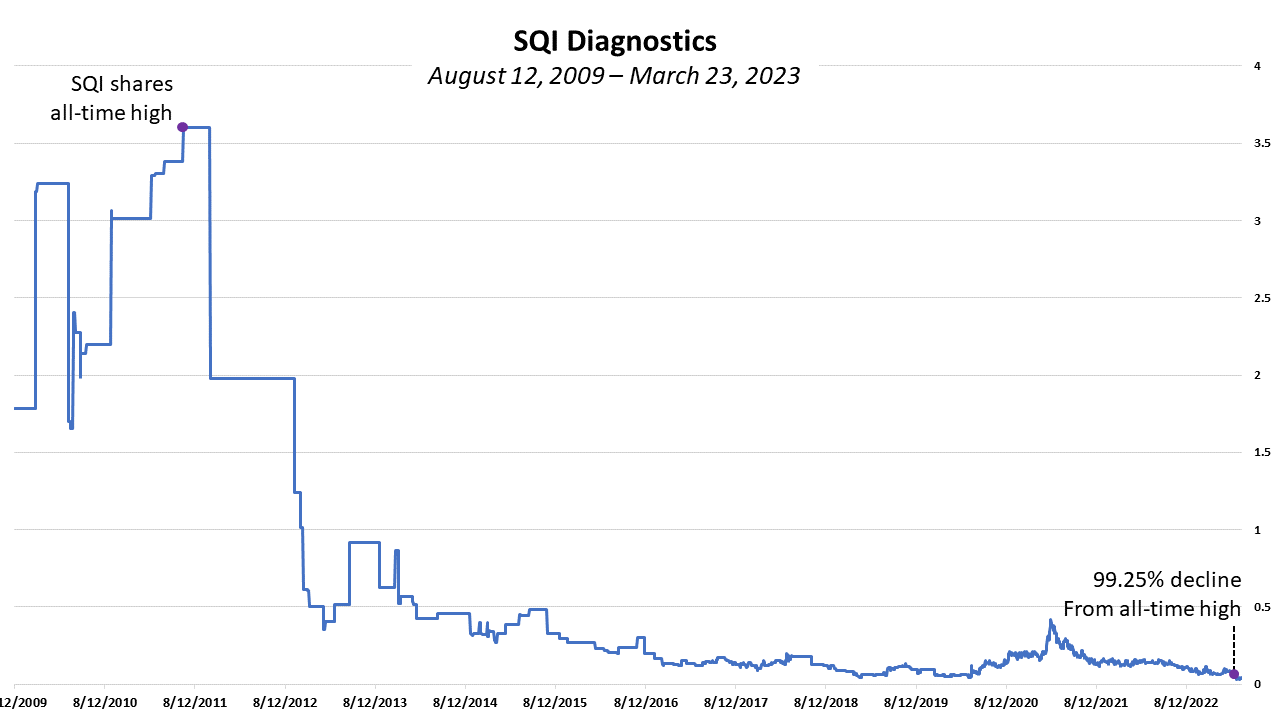

The timing is excellent to buy and hold the shares of SQI Diagnostics (SQI) for a 10X to 100X gain. The share price at its all-time low in early March 2023 was 99.25% below its 2011 all-time high. SQI shares trade in Canada (symbol:SQD) and also in the U.S (symbol: SQIDF).

Please note. For why SQI Diagnostics has the best risk reward metrics of any stock that I have recommended since 1978 see my conclusion at bottom of the page. Also view recent video Money TV interviews of myself about SQI and Andrew Morris, CEO of SQI at bottom of page.

Based on my 46 years of experience in the markets the best time to buy an early-stage medical biotech, medical device or testing company that has Intellectual Property (IP) which requires government approval, is after the company’s IP submission gains government approval. Below is the typical IPO-to-government-approval share price depreciation/appreciation cycle for medical companies that have proprietary IP:

-

- Company with IP raises money via public offering.

- Clinical trials and waiting game for regulatory approval begins

- Share price subsequently climbs to all-time high in less than a few years.

- Share price trends lower and to all-time low since approval always requires more time than projected.

- Government approval obtained at or near all-time low.

- Share price climbs back to all-time high.

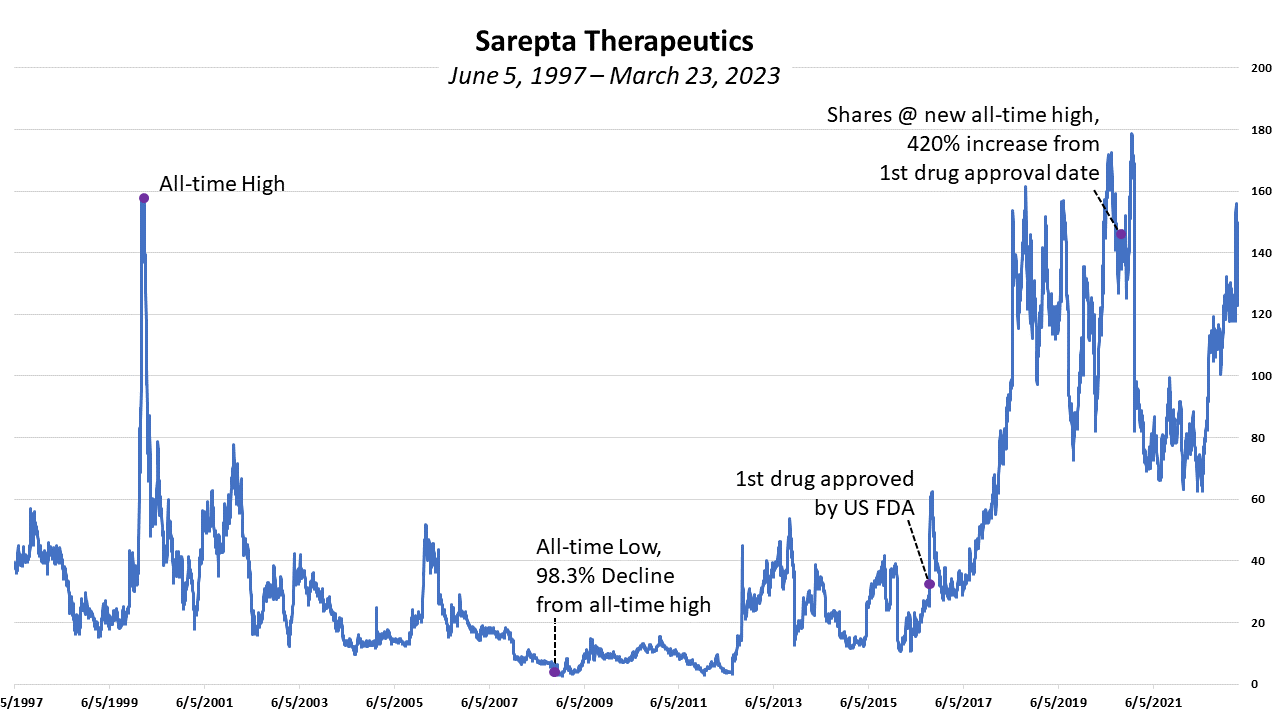

Sarepta Therapeutics, Inc. (SRPT) is a good example. The chart below depicts that SRPT’s share price followed the cycle. The high share price on the 06/04/1997 date of its IPO was $40.50. After reaching an all-time high of $162.00 on 02/09/2000 SRPT declined to an all-time low of $2.70 on 11/21/2008. On 09/19/2016, when Sarepta’s first drug was approved by the FDA, a share could have been purchased for as low as $28.10. Since then, a SRPT share has traded as high as $181.83. The share price eclipsed its 2000 all-time high on 10/01/2018. For the approximate 24 months from the approval to the new high the share price multiplied by five times.

The chart below depicts that SQIDF’s share price has also been following the cycle. The share price on 8/12/09 its first day of trading closed at $1.78. The shares reached their all-time high of $3.60 on 06/27/2011. The share priced reached their all-time low of $0.027 on 03/02/2023.

SQI Diagnostics is a leader in the science of lung health. They develop and manufacture 15-minute point of care tests for respiratory health and precision medicine. SQI’s tests simplify and improve respiratory distress testing, donor organ transplant informatics and post transplant patient monitoring.

In short, SQI helps doctors identify risks to their patient’s lung health so they can make good choices and deliver the best and most economic care possible.

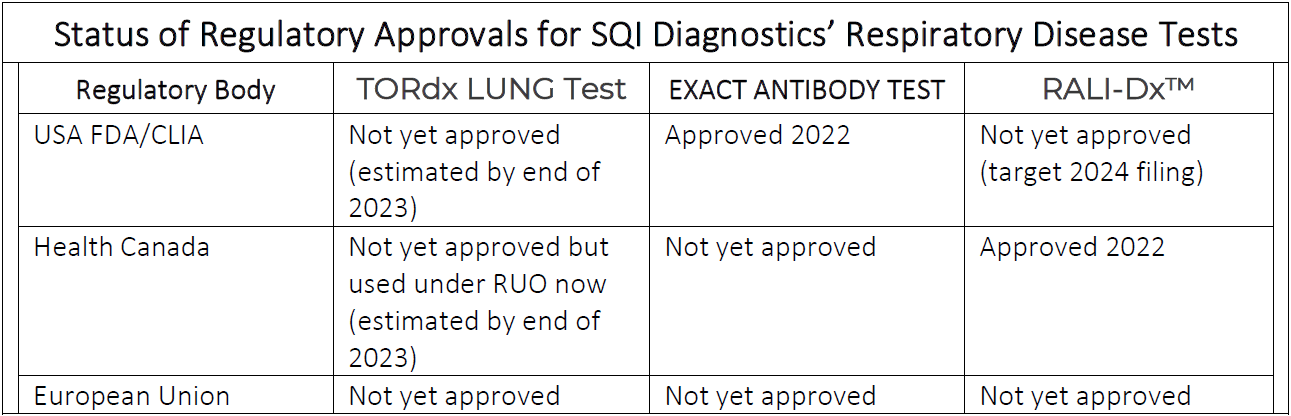

SQI has developed the following completely novel tests that address unmet needs in respiratory health, which have either been approved by or are awaiting approval from the Health Canada, U.S. FDA and EU EMEA regulatory bodies:

-

- Transplantable Lungs- SQI has developed TORdx Donor Lung Test™ -a novel diagnostic test with over a 80% accuracy rate. This test will enable surgeons to know if a donor lung will be highly likely to do well in the recipient’s body and to increase the unmber of lungs that are transplanted (LUNG). Currently over 80% of all donor lungs are discarded because there is no test to help decide between good and bad donor lungs. Lung Transplants cost over $1,000,00.00 USD and are one of the largest profit centers for any hospital. There are no diagnostic tests available currently, a surgeon simply looks and feels the organ for any impurities. To determine if it will be accepted.

In a recent announcement by the Federal Government is going to shake up the transplant business and how transplant organs are managed. The new system is completely in SQI’s testing favor. See “Troubled U.S. Organ Transplant System Targeted for Overhaul”, Washington Post, 03/22/23.

-

- Covid antibodies- SQI’s self-administered test, The EXACT ANTIBODY TEST™ is the ONLY QUANTITATIVE test that measures all 6 biomarkers. The level of antibodies is critical. It indicates the degree of immunity for vaccinated and unvaccinated individuals. This test with over a 99% accuracy rate will also tell you if your immunity is from a vaccine/booster or whether you had Covid. If the antibodies are below a certain threshold the individual now can take control of their own health. They can decide whether they want to take a vaccine/booster, socially distance or wear a mask or not go out in public. This test is covered by most major insurance companies.

The majority of the world population mistakenly believe that they have immunity from Covid 19 from having the disease or having been vaccinated. As more gain an understanding that immunity from both wanes over time the demand for self-administered tests will increase substantially. See “A look at how antibodies from a COVID-19 infection and vaccination wane over time”, PBS 10/19/21

-

- Respiratory diseases diagnostics (RALI-Dx Triage Test™) tests- SQI’s RALI-DX was developed to be utilized by hospitals. RALI-DX is a triage tool aid doctors to make better treatment decisions – send patient home or admit to hospital or to treat with advanced respiratory care measures. This test is currently approved by Health Canada. In Emergency Room Triage, patients with respiratory infections or trauma are either sent home to rest and quarantine or are admitted to the hospital because the probability is high for the lungs to go into distress. RALI-fast will be a test, similar to the “heart attack” point of care test by Biosite, that will help doctors send patients home or treat them aggressively – no test currently does this – and all in 15 minutes. 50% of all intensive care unit (ICU) admittances are related to a patient’s inability to breath normally. Thus, since all hospitals are overcrowded, every hospital on the planet is in need of SQI’s RallyDX diagnostic system. It can cost over $10,000 a day to keep a patient in the ICU — even more if they are intubated. A 15 minute test by SQI could significantly reduce this cost and overcrowding in the ED.

For more about SQI’s testing products see “Four Diagnostic Products in the Pipeline at SQI”, March 3, 2023.

The table below contains the status of the approvals for SQI’s three key product lines by the U.S., Canadian and European Union regulatory bodies. All three provide significant upside for SQI and its shareholders.

SQI Tests underdevelopment

-

- RALI-fast™ is a 15-minute version of the test that is nearing completion and can be used to triage ED patients and to monitor ICU patients. This is a massive market — there are over 25 million patient days in US ICUs alone. The ICU Test has been trialed in a leading ICU with very positive feedback.

- Breathe™ — a simple, take-at-home test for lung transplant patients that monitor for post-operation infection which occurs in over 55% of lung transplant patients, and another for organ rejection. (Comparable is CAREdx). This test where patient’s breath is collected replaces a complicated, expensive and risky in-hospital surgical biopsy procedure. Breathe tests extend SQI’s product line into the highly valuable post-transplant monitoring markets like NASDAQ listed CAREdx (symbol: CDNA) which at 3/30/23 had a market cap of $489 million.

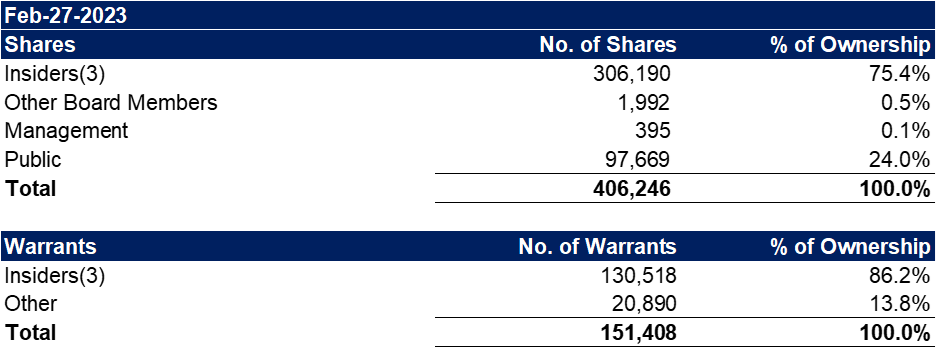

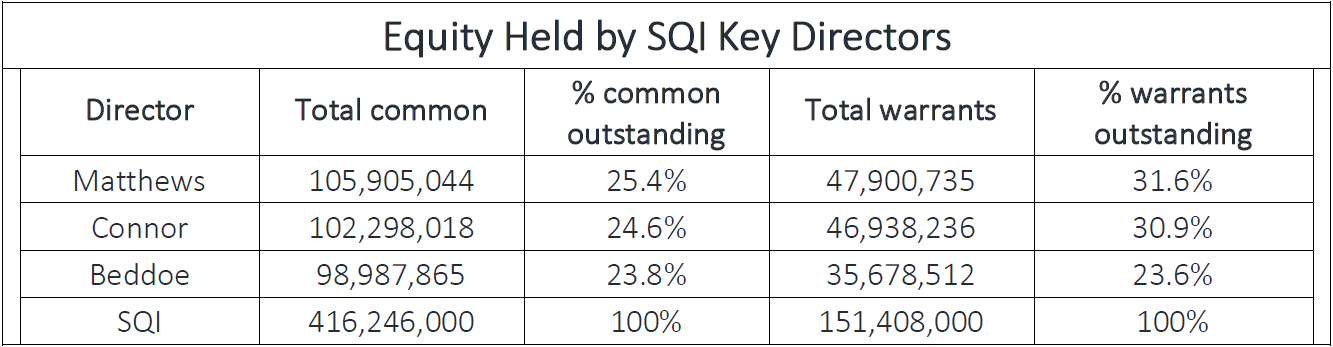

At first blush the debt on SQI’s Balance Sheet indicates substantial risk. However, the risk for the Balance Sheet is mitigated since $9.7 million of the $16.2 million in total debt were loans that were provided by the company’s board members. Most importantly, three SQI board members (Insiders) hold 75.4% of SQI common shares and 86.2% of its outstanding warrants:

The three key directors, are among the most prominent members of Canada’s professional investor and investment banking community.

-

- Wilmot Matthews, former investment banker and Vice Chairman of BMO Nesbitt Burns. He and his wife donated $25 million to city of Toronto for a park.

- Clive Beddoe, founder of Hanover Holding and Investment Company, which manages approximately $200 million. Also founder of Westjet Airlines whose investment banker was Wilmot Matthews.

- Gerald Connor, founder of Cumberland Private Wealth Management, Inc., one of Canada’s largest investment management firms.

The paragraph below is an excerpt from the company’s March 28, 2023 “SQI to Focus on Development of Point of Care Products In Respiratory Health” announcement.

“As a part of SQI’s new strategy going forward, the Company has reduced its workforce from approximately 44 full-time employees to 20 full-time employees to focus on maintaining and developing the Company’s key capabilities of clinical and regulatory expertise, managing outsourced product development and outsourced manufacturing. The Company expects to reduce its payroll and cash burn by approximately 50% on a monthly basis. In connection with this evolution of the Company’s strategy, SQI intends to entertain offers from potential buyers for the Company’s now, non-core business that is based on lab-based instruments. The Company’s leadership will remain intact, including regulatory, clinical and finance roles.”

On 3/24/23, SQI announced that its insiders would be selling their shares to utilize the proceeds to exercise the money warrants that they hold. See “SQI DIAGNOSTICS ANNOUNCES PROPOSED INSIDER SALES AND WARRANT EXERCISES TO FUND COMPANY”. The announcement stated that insiders, who held warrants in SQI, would be selling shares at the “prevailing market price”. The proceeds from the sales were to be utilized to exercise the warrants they hold at exercise prices of $0.12 to $0.21 per share.

Conclusion

SQI’s strategy of having insiders sell shares at below the warrant exercise prices and then to utilize the proceeds to exercise the warrants they hold at prices which are above the prices the shares were sold for is not new. The strategy was successfully deployed by the three insiders to provide capital to SQI on three prior occasions.

SQI has the best risk reward ratio of any stock that I have ever recommended throughout my 46 year career. SQI is an extremely rare opportunity for two reasons:

-

- Established or added to their legacies- SQI is a “change and improve the world” project.

- Protected or enhanced their reputations- A failure for any company in which they are board member would hurt their reputation.

- Increased their net worths by at least $174 million

To finance SQI, the three whales utilize a strategy of selling their common shares at prevailing market prices when it needs capital. They then utilize the proceeds to exercise their warrants which have higher strike prices than the price their common shares were sold. Thus, these whales provide an extremely rare opportunity for suckerfish or whalesuckers to have a free ride on their backs (purchase shares in open market near all-time low) to make approximately 20 times their investment.

ShinyPennyStocks.com recommends that buy price limit orders at $0.05 be utilized to purchase SQIDF shares. For future limit price order changes and updates on SQI Diagnostics subscribe to ShinyPennyStocks.com.

Below are Money TV’s 3/31/23 interviews of SQI’s CEO, Andrew Morris and myself about SQI.

Recent Comments